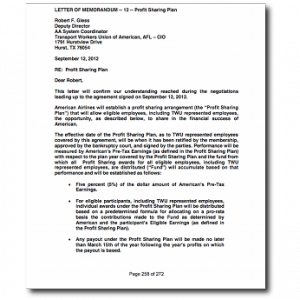

RE: Profit Sharing PlanDear Robert,

RE: Profit Sharing PlanDear Robert,

This letter will confirm our understanding reached during the negotiations leading up to the agreement signed on September 12, 2012.

American Airlines will establish a profit sharing arrangement (the “Profit Sharing Plan”) that will allow eligible employees, including TWU represented employees, the opportunity, as described below, to share in the financial success of American.

The effective date of the Profit Sharing Plan, as to TWU represented employees covered by this agreement, will be when it has been ratified by the membership, approved by the bankruptcy court, and signed by the parties. Performance will be measured by American’s Pre-Tax Earnings (as defined in the Profit Sharing Plan) with respect to the plan year covered by the Profit Sharing Plan and the fund from which all Profit Sharing awards for all eligible employees, including TWU represented employees, are distributed (“Fund”) will accumulate based on that performance and will be established as follows:

- Five percent (5%) of the dollar amount of American’s Pre-Tax Earnings.

- For eligible participants, including TWU represented employees, individual awards under the Profit Sharing Plan will be distributed based on a predetermined formula for allocating on a pro-rata basis the contributions made to the Fund as determined by American and the participant’s Eligible Earnings (as defined in the Profit Sharing Plan).

- Any payout under the Profit Sharing Plan will be made no later than March 15th of the year following the year’s profits on which the payout is based.

- All other terms and conditions are covered under the Profit Sharing Plan document.

This Letter of Agreement shall supersede all prior LOAs establishing a profit sharing plan for TWU employees.