For our Brothers and Sisters retiring Please read this:

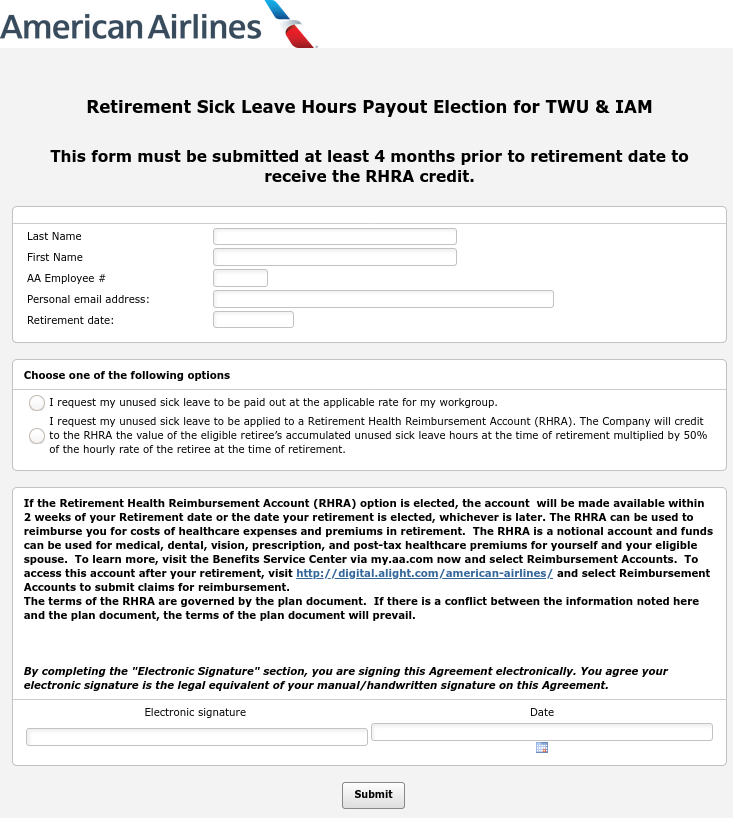

The Difference between the RHRA and the “applicable rate for my work group” is

RHRA = accumulated unused sick leave hours at the time of retirement multiplied by the 50% of the hourly rate of the retiree at the time of retirement.

“Applicable rate for my work group”= The cash payout amount is calculated by multiplying your retirement sick hours by $10.80. After applicable taxes, the balance will be deposited electronically to the banking institution where your payroll checks were received once your retirement has been processed.

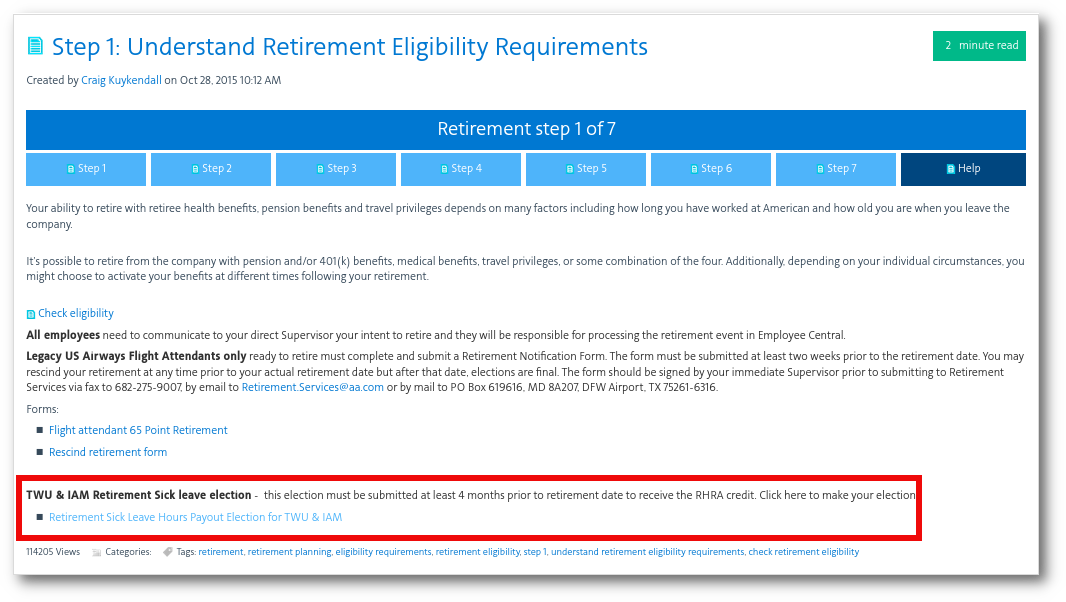

Step 1: Understand Retirement Eligibility Requirements

TWU & IAM Retirement Sick leave election – this election must be submitted at least 4 months prior to retirement date to receive the RHRA credit. Click here to make your election:

NOTE: The 4 month prior requirement has been waived until further notice

Here is the link to the Retirement Planning guide: https://newjetnet.aa.com/docs/DOC-11649

This is what the Form Looks like:

ARTICLE 29 –BENEFITS

G.SICK LEAVE CONVERSION TO HEALTH RETIREMENT ACCOUNT

The Company shall establish a Health Reimbursement Account(“HRA”) for eligible TWU/IAM Association represented retirees who:

1.Meet the retirement criteria of the 65-point plan or equivalent policy and retire from the Company;

and

2.Gives the Company at least four (4) months’ advance notice of the employee’s intent to retire. For each such eligible retiree, the Company will credit to a national HRA account the value of the eligible retiree’s accumulated unused sick leave hours at the time of retirement multiplied by the 50% of the hourly rate of the retiree at the time of retirement. The HRA account credits may be used for qualified retiree medical expenses for any qualified retiree medical plan. The HRA account credits may only be used to reimburse the retiree for unreimbursed, substantiated, qualified medical expenses of the retiree and/or eligible dependents up to the retiree’s HRA account credit balance. The HRA must comply with all applicable laws and regulations. The Company will be responsible for drafting and maintaining the HRA plan documents(s) and will have discretion over all plan-related items not addressed in the Agreement. The Company shall have the right to amend any provision of the HRA plan that is required by applicable law oris necessary to maintain the tax qualified status of the plan.